Market Insights

Highest and Best Use

Weekly Blog #14 “Price is what you pay. Value is what you get.” Warren Buffett June’s commentary, What’s It Worth?, looked at the many ways real estate can be valued—from comps and replacement cost to cap rates and discounted cash flows. But one critical concept I didn’t cover is the

Crisis Management

Weekly Blog #14 “You keep using that word. I do not think it means what you think it means.” Inigo Montoya, The Princess Bride Word out of Washington is that the Trump Administration is considering whether to declare a national housing emergency. On the surface, the reasoning is understandable. Home

What Are the Odds?

Weekly Blog #13 “We should be at least two to three points lower—if things later change to the negative, increase the rate.” President Donald Trump It’s no secret that President Trump has been extremely unhappy with Federal Reserve Chair Jerome Powell and his reluctance to lower interest rates. Trump, a

You’re Fired!

Blog #12 “The Federal Reserve is like universal basic income for PhD’s”—Scott Bessant The Federal Reserve is the most powerful institution in the global economy—and one of the least understood. Created by Congress in 1913, the Fed was originally tasked with maintaining financial stability. That mission later expanded to a

Too Big to Succeed

Weekly Blog #11 They (Freddie Mac & Fannie Mae) are one half fish, one half fowl—Ben Bernanke There are few institutions more misunderstood—or more influential—in the housing industry than Freddie Mac and Fannie Mae. Most people know the names, but haven’t a clue as to what they do. They aren’t

The Affordable Housing Myth

Weekly Blog #10 “There is no such thing as a free house.” Milton Friedman paraphrase “There’s no such thing as a free house; someone always pays the mortgage.” Milton Friedman’s warning may pre-date our current housing debates, but the lesson is timeless. Lately the rallying cry has been, “eliminate greedy

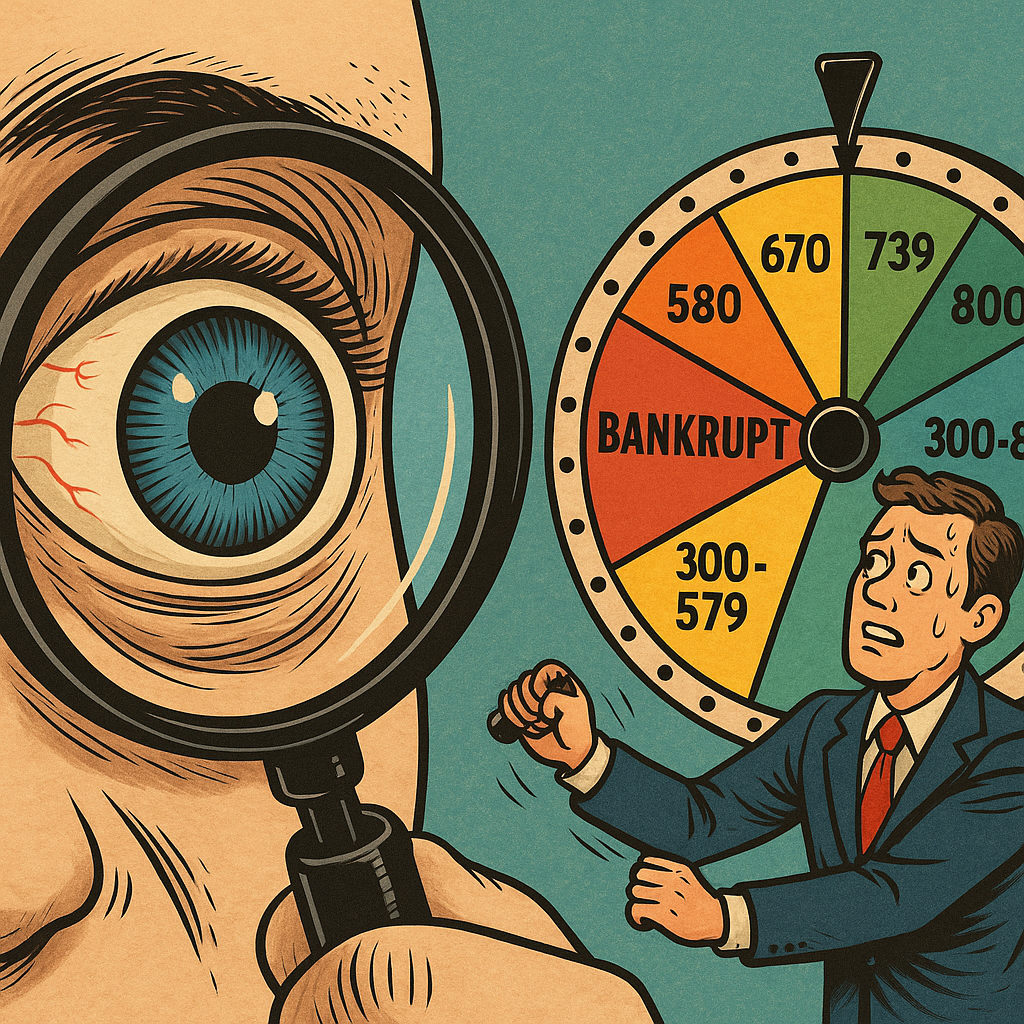

Is Isaac Fair?

Weekly Blog #9 “There is nothing either good or bad, but thinking makes it so.” William Shakespeare Let’s start with a question: What does your credit score really say about you? If you’re like most people, you might assume that it measures financial responsibility, discipline, or even moral worth. After

What’s it Worth?

Weekly Blog #8 “Price is what you pay. Value is what you get.” Warren Buffett Adam Smith’s invisible hand tells us that in a free market, prices are set by what a buyer is willing to pay and a seller is willing to accept. And for many goods and services,

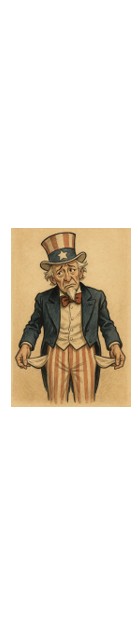

Creative Accounting

Weekly Blog #7 “I’d gladly pay you Tuesday for a hamburger today.” Wimpy Washington bureaucrats would like the rest of us to believe that government accounting is somehow different—and more complicated—than personal or corporate accounting. They suggest that managing the federal coffers requires the knowledge and expertise of the managerial