Market Insights

December 2024

The Gilded Standard “Gold is money. Everything else is credit” J.P. Morgan For centuries, gold served as the foundation of Western economic systems due to its intrinsic value, scarcity, and role as a reliable store of wealth. The gold standard, formalized in the 19th century, ensured that every dollar issued

November 2024

Cause and Effect “Nothing good can come from the Federal Reserve. It is the biggest taxer of them all. Diluting the value of the dollar by increasing its supply is a vicious, sinister tax on the poor and middle class.” Ron Paul Among the many topics debated going into the

October 2024

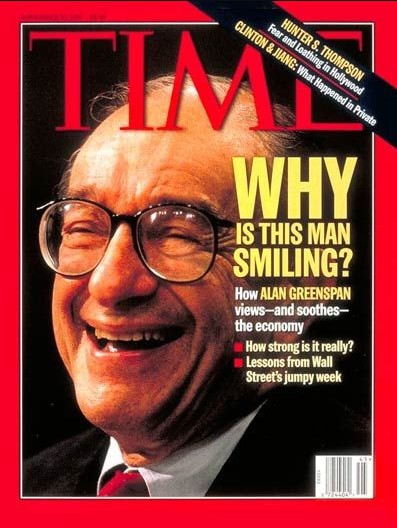

Economic Alchemy “We’re all Keynesians now.” Richard Nixon Undergraduate econ students are typically introduced to several schools of monetary theory, such as Classical, Keynesian, and Modern—although in good conscience I hesitate to refer to the last one as a legitimate academic theory. Here’s a quick summary of each: Classical Theory–Milton

September 2024

Price Controls “As president, I will go after the bad actors. And I will work to pass the first-ever federal ban on price gouging on food.” Kamala Harris Between 1965 and 1968, Lyndon Johnson’s Great Society social welfare programs increased government spending (demand-side economics) by 60%, which, not surprisingly, increased

August 2024

Fast Nickels “The first object of taxation is to secure revenue. But if the rates on large incomes are so high that they disappear, the small taxpayer will be left to bear the entire burden.” Calvin Coolidge The U.S. national debt is currently $35 trillion. The federal deficit—the difference between

July 2024

NIMBY “Contrary to the vision of the left, it was the free market which produced affordable housing—before government intervention made housing unaffordable.” Dr. Thomas Sowell Home ownership has long been considered the American Dream. However, since 2020 U.S. home prices have risen 34%, and mortgage rates surged from 3.72% to

June 2024

Pathway to Poverty “The only way in which a durable peace can be created is by world-wide restoration of economic activity and international trade.” James Forrestal President Biden recently announced a wave of new tariffs on Chinese imports: 100% on electric vehicles, 50% on semiconductors, 50% on solar panels, 25%

May 2024

The Fed Put “The U.S. government can’t go bankrupt because we can print our own money.” Jared Bernstein In the 1970s, Federal Reserve chairman, Arthur Burns, a Keynesian economist, attempted to rescue an economy hobbled by price controls, protectionist trade policies, and misguided fiscal policies, with monetary stimulus. Burns’ loose

The Advantages of Private Lending for Real Estate Investors

Introduction: Private lending has emerged as a compelling alternative for real estate investors seeking flexible financing solutions beyond traditional avenues. In this blog post, we delve into the distinct benefits that private lending offers to investors navigating the dynamic landscape of real estate investment. Greater Flexibility: Unlike conventional lending institutions,