Fast Nickels

“The first object of taxation is to secure revenue. But if the rates on large incomes are so high that they disappear, the small taxpayer will be left to bear the entire burden.” Calvin Coolidge

The U.S. national debt is currently $35 trillion. The federal deficit—the difference between tax revenues and expenses—is projected to average over $2 trillion annually over the coming decade, at which point federal debt outstanding will surpass $56 trillion, or approximately 137% of future GDP. Houston, we have a problem.

In 2023 the federal government paid $658 billion in net interest. By 2035 annual interest will exceed $2 trillion, or triple last year’s amount. These numbers are both staggering and terrifying.

Progressive pundits claim that the problem is simple; corporations and the rich aren’t paying their fair share, and we must increase tax rates on both. In stark contrast, conservatives argue that Uncle Sam has a spending as opposed to a revenue problem, and lay blame at the feet of profligate bureaucrats and an out-of-control federal government.

Who is right? Let’s first look a breakdown of who pays taxes. The top 1% of income earners pay 46% of all federal taxes collected. The top 10% pay 76%, the top 25% pay 89%, and the bottom 40% effectively enjoy a negative tax rate, meaning they receive a refund larger than their withholdings. It would be hard to argue that the U.S. tax Code isn’t extremely progressive, or that the poor and middle-class shoulder most of the tax burden.

What about corporations? Prior to 2017 US corporate tax rate was 38.9%, however the Tax Cut and Jobs Act reduced it to 25.8%, or nearly identical to the 26.1% average rate for G7 countries.

In 1962 Democratic President John F. Kennedy made his case for lower taxes, stating, “it is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut the rates now.” He went on to explain that “efforts to avoid tax liabilities” make “certain types of less productive activity more profitable than other more valuable undertakings, which inhibits growth and efficiency.” Therefore the “purpose of cutting taxes” is “to achieve the more prosperous, expanding economy.” Truer words have never been spoken.

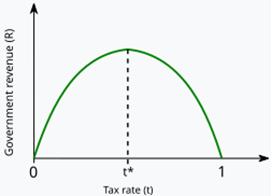

The objective of tax policy should be twofold: maximize revenue and promote economic growth. At first blush, those two goals appear to be mutually exclusive, but with sensible, impartial policy they’re perfectly aligned—fast nickels versus slow dimes. How do we know this? The Laffer Curve perfectly illustrates the relationship between tax rates and revenue. At the point where tax revenues become unduly punitive, capital investment and risk-taking activities decrease, and so too do earnings and taxes.

Put another way, every percent increase in tax rates decreases the investor’s net return, or what is known is diminishing marginal utility. In the same way that increased risk requires a commensurate increase in potential return, higher taxes require a proportionate after-tax return to entice investors to put their capital at risk.

There’s a similar scenario presently playing out at the state level, where high income earners are fleeing high tax states and moving to low or no tax states, with California being the poster child for tax flight. The Golden State is currently facing a massive budget shortfall of $37.9 billion, as both personal and corporate tax revenues have collapsed due to an exodus of high-income earners and corporations relocating to Florida, Texas, Tennessee and other more tax-friendly states.

Ask any business owner what would happen if the corporate tax rate increased and the immediate response is, “We’d raise retail prices.” No different than cost of goods, labor or rent, corporate taxes are simply a line-item expense on a profit and loss statement. Companies must generate a profit in order to continue operations, consequently if any expense increases, companies simply raise retail prices to maintain their required margin of profit. As the old saying goes, “Companies don’t pay taxes—their customers do.” Companies are merely the middle man.

While individuals and corporations can freely move to different states, moving to another country is a more complex and challenging proposition. When taxes become punitive, very few people will relinquish their citizenship and relocate to another country. They will, however, as President Kennedy explained, curtail their investment and entrepreneurial activities.

Capital projects, such as commercial real estate, public transit systems, airports, and energy infrastructure all require funding. Private and public entities alike all rely on the capital market to loan the funds for those projects. But capital markets require surplus savers, and if the savings is hoovered out via onerous taxation then the funding will become both scarce and costly. And when the cost is too great, those projects die out, and all of the associated jobs and trickle-down economic benefits die with them.

Contrary to the whimsical image of the Monopoly Man holding a bag of cash, wealthy people invest their money; in businesses, real estate, stocks, bonds, precious metals, and non-traditional assets. Every additional dollar taken from them must first be liquidated from some productive asset/investment, reducing available capital, increasing the cost (of capital), and redirecting productive assets into present consumption, with a corresponding loss of all future growth, revenue, and associated taxes.

History is crystal clear in that punitive tax rates always and everywhere discourage risk-taking and entrepreneurial activity and result in lower tax revenues, not higher. But sensible austerity combined with pro-growth economic policies could quickly turn the deficit into a surplus. The solution is faster nickels, not slower dimes.

Mark Lazar, MBA

CERTIFIED FINANCIAL PLANNER™

WasatchFinance.com